URD 2023

-

INTRODUCTION

Euronext N.V. (the “Company” or “Euronext” and together with its subsidiaries, the “Group”) is a Dutch public company with limited liability (naamloze vennootschap), whose ordinary shares are admitted to listing and trading on regulated markets in the Netherlands, France, Belgium and Portugal. The applicable regulations with respect to public information and protection of investors, as well as the commitments made by the Company to securities and market authorities, are described in this Universal Registration Document (the “Universal Registration Document”).

In addition to historical information, this Universal Registration Document includes forward-looking statements.

The forward-looking statements are generally identified by the use of forward-looking words, such as “anticipate”, “believe”, “estimate”, “expect”, “intend”, “plan”, “project”, “predict”, “target”, “will”, “should”, “may” or other variations of such terms, or by discussion of strategy. These statements relate to Euronext’s future prospects, developments and business strategies and are based on analyses or forecasts of future results and estimates of amounts not yet determinable. These forward-looking statements represent the view of Euronext only as of the dates they are made, and Euronext disclaims any obligation to update forward-looking statements, except as may be otherwise required by law. The forward-looking statements in this Universal Registration Document involve known and unknown risks, uncertainties and other factors that could cause Euronext’s actual future results, performance and achievements to differ materially from those forecasted or suggested herein. These include changes in general economic and business conditions, as well as the factors described in section 2.1 - Risk Factors of this Universal Registration Document.

This universal registration document has been filed with the Stichting Autoriteit Financiële Markten (the “AFM”) on 28 March 2024 as competent authority under Regulation (EU) 2017/1129 without prior approval pursuant to Article 9 of Regulation (EU) 2017/1129. This universal registration document may be used for the purposes of an offer to the public of securities or admission of securities to trading on a regulated market if approved by the AFM together with any amendments, if applicable, and a securities note and summary approved in accordance with Regulation (EU) 2017/1129.

This copy of the annual financial reporting of Euronext N.V. for the year ended 31 December 2023 is not presented in the ESEF-format as specified in the Regulatory Technical Standards on ESEF (Delegated Regulation (EU) 2019/815). The ESEF single reporting package is available at: https://www.euronext.com/en/investor-relations/financial-information/financial-reports

Stéphane Boujnah

“The migration of Borsa Italiana’s derivatives to Optiq in Q1 2024 and the expansion of Euronext Clearing to Euronext listed derivatives by Q3 2024 will complete our presence on the entire trading value chain and will position Euronext ideally to capture future growth opportunities.

As we celebrate the 10 year anniversary of our IPO in 2024, I am looking forward to deep-dive into the opportunities that this transformation will offer for Euronext in the coming years at our Investors Day in November 2024.”

Dear Shareholders

In 2023, Euronext was able to demonstrate that it is more diversified and stronger than ever.

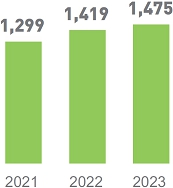

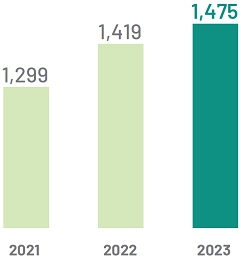

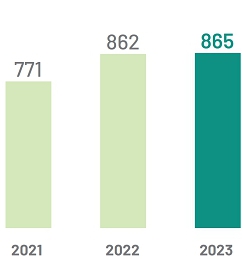

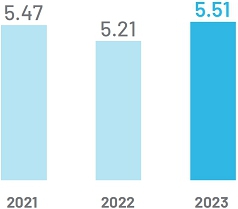

Euronext reached record revenue close to €1.5 billion in 2023, resulting from the strong performance of our non-volume related activities and excellent performance of our fixed income and power trading franchises. Thanks to our trademark cost discipline, positive FX impacts and a one-off accruals release, we reported lower costs than our 2023 cost guidance. As a result, we achieved an adjusted EBITDA of €864.7 million, which translated into an adjusted EPS of €5.51. Consequently, we will propose a total dividend of €256.8 million at our next annual general meeting to be held in May 2024.

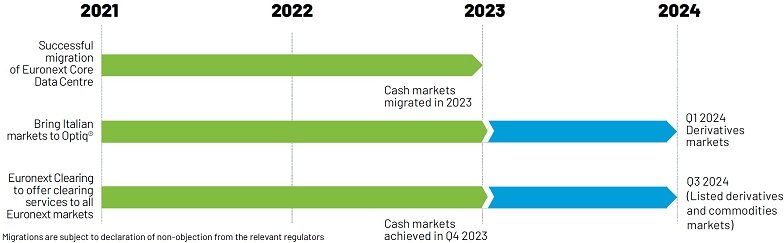

Importantly, in 2023, we were able to demonstrate once again our exceptional integration capabilities. We delivered some of the key milestones of our ‘Growth for Impact 2024’ strategic plan. With the successful migration of Borsa Italiana’s cash markets to Optiq®, Euronext was able to reinforce its leadership in cash equity trading across Europe. We are today uniting 25% of European equity trading on Euronext’s single technology platform, forming the largest liquidity pool in Europe.

In November 2023, we established Euronext Clearing as the CCP of choice for Euronext’s cash markets, with the expansion of its offering to Belgium, France, Ireland, the Netherlands and Portugal. We also set MTS as a recognized interdealer platform for the implementation of electronic market making on European Union issued debt instruments, with very dynamic first volumes. These projects have contributed to the €74 million of run-rate cumulated EBITDA synergies delivered by end of 2023, above the €70 million 2023 intermediary target. This is already more than the €60 million of run-rate cumulated EBITDA synergies targeted for the end of 2024 we initially announced in April 2021, at the time of the completion of the Borsa Italiana Group acquisition.

Throughout the year, we continued to consolidate our leadership position in the listing of equities in Europe, welcoming 64 new companies on our market, and attracting the majority of international listings in Europe. In addition, we continued to support the financing of the real economy through capital markets, with more than 300 issuers that raised €20 billion on Euronext through follow-on transactions to fund their growth and investment projects. We consolidated our position as the first debt listing venue worldwide, with more than 55,000 total bonds listed on our market. Euronext has also further solidified its position as the world leading venue for sustainable bonds, with more than 450 new ESG bond listings in 2023 raising more than €280 billion.

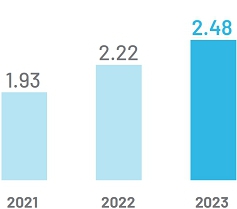

In July 2023, we disposed our 11.1% stake in LCH SA. Together with our strong cash generation capabilities, this enabled us to perform a €200 million share buy-back programme over the second half of the year. This programme did not impact our deleveraging path. At the end of 2023, our net debt to adjusted EBITDA ratio reached 1.9x. This compares to 3.2x post acquisition of the Borsa Italiana Group in 2021.

In 2024, we will bring the Italian derivatives markets to our single trading platform, Optiq®. Euronext Clearing will become the clearing house for listed derivatives and commodities markets in Q3 2024. This strategic transformation will result in Euronext’s presence across the entire trading value chain on the markets it operates, ideally positioned to capture future growth opportunities. We are well on track to deliver on our upgraded target of €115 million of cumulated run-rate EBITDA synergies by the end of 2024, as well as our medium-term revenue and EBITDA growth targets for 2024 set in the ‘Growth for Impact 2024’ strategic plan.

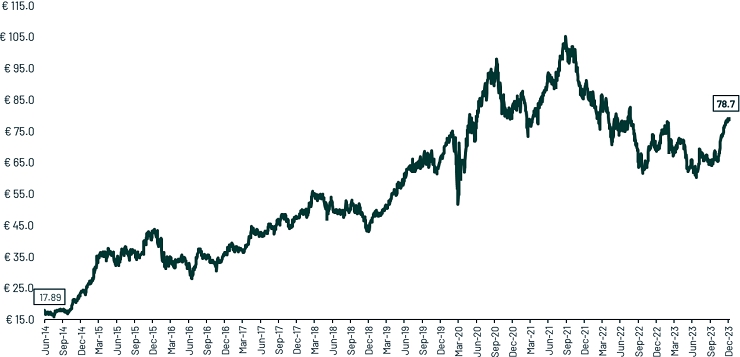

2024 marks the 10 years anniversary of Euronext since its IPO, and allows us to observe the exceptional growth transformation the group has undergone during the last 10 years. We have expanded across the entire trading value chain, and have extended the range of products we provide to our clients, such as power trading, forex or fixed income. The delivery of the last bricks of our strategic plan will unlock new innovation capabilities for us, which we will further detail with the release of our new strategic plan for 2027 on our investor day in November 2024.

Stéphane Boujnah

€74m

RUN-RATE

SYNERGIES

DELIVEREDSynergies achieved above the interim target of €70 million by end of 2023

Successful migration of Italian cash markets to Optiq®

Successful expansion of Euronext Clearing as pan-European clearing house for cash markets

€103 million of cumulated implementation costs incurred at the end of 2023

The migration of Italian derivatives markets to Optiq in Q1 2024 and the expansion of Euronext Clearing to Euronext listed derivatives by Q3 2024 will significantly contribute to reaching the targeted €115 million run-rate annual EBITDA synergies by end of 2024.

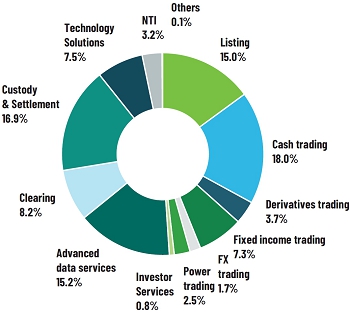

A more diversified revenue base with non-volume related revenue accounting for 60% of total revenue and income of €1,475 m

Underlying revenue and income as well as Adjusted EBITDA are defined in section 5.2 - Other Financial Information

(c) Non-volume related revenue include Advanced Data Services, Custody and Settlement, Technology Solutions, Listing exc. IPO fees, Investors Services, fixed fees arising from Clearing activities and NTI through CCP activities

OUR AMBITION OUR PURPOSE OUR MISSION Build the leading market infrastructure in Europe Shape capital markets for future generations Connect European economies to global capital markets, to accelerate innovation and sustainable growth “IN 2024, EURONEXT WILL CONTINUE ITS COSTS CONTROL POLICY AND EXPECTS THAT SAVINGS AND SYNERGIES WILL OFFSET INFLATION AND 2023 COSTS RAMP-UP. AS A RESULT, EURONEXT EXPECTS ITS 2024 UNDERLYING EXPENSES EXCLUDING D&A TO BE AROUND €625 MILLION, INCLUDING AROUND €10 MILLION TO FINANCE GROWTH PROJECTS AND EXCLUDING POTENTIAL IMPACT FROM FX OVER THE YEAR.”

Financial

targets solely based on organic growth, excluding any new M&A contributions and driven by higher growth expected in non-volume

related activities

Financial

targets solely based on organic growth, excluding any new M&A contributions and driven by higher growth expected in non-volume

related activities Expected

uplift in profitability from the integration of the Borsa Italians Group combined with continued best-in-class cost discipline

Expected

uplift in profitability from the integration of the Borsa Italians Group combined with continued best-in-class cost discipline Including

€115 million of run-rate pre-tax synergies from the integration of the Borsa Italiana Group (2) and €150 million of non-recurring implementation costs (3).

Including

€115 million of run-rate pre-tax synergies from the integration of the Borsa Italiana Group (2) and €150 million of non-recurring implementation costs (3). Acquisitions

expected to contribute to higher organic revenue growth, provide scalability and/or improve exposure to non-volume

related businesses

Acquisitions

expected to contribute to higher organic revenue growth, provide scalability and/or improve exposure to non-volume

related businessesTake recent successes to the next level Continue to review transformational deals  Corporate

Services

Corporate

Services Post-trade

solutions

Post-trade

solutions Investor

Services

Investor

Services Strengthen

the pan-European infrastructure model

Strengthen

the pan-European infrastructure model Diversify

the revenue mix

Diversify

the revenue mix[1] Pro forma for the acquisition of the Borsa Italiana Group, excluding transitional revenue and cost.

[3] Upgraded implementation costs announced in May 2022 [-€10 million compared to implementation costs announced in November 2021].

1 FOR EURONEXT: Commit to the alignment of our own emissions with a 1.5-degree trajectory, the most demanding climate ambition, under the Science-Based Targets initiative.

Emission reduction targets validated by SBTI Progress achieved in 2023 Operational emission reduction target

• 73.5% reduction of Euronext’s Scope 1 and Scope 2 market-based greenhouse gas emissions by 2030 compared to 2020

• At least 46.2% reduction of Euronext’s Scope 3 travel emissions by 2030 compared to 2019

• Combined Scope 1 and Scope 2 (market-based) emissions decreased by 79% compared to 2020, primarily attributed to the adoption of green electricity and renewable energy sources

• Scope 3 travel emissions decreased by 37.6% compared to 2019, signaling progress despite gradual travel resumption

• 32% of suppliers, representing over 72% of emissions from purchased goods and services, established SBTi targets by December 2023

Supplier engagement target

• By 2027, Euronext suppliers, representing 72% of Euronext’s greenhouse gas emissions derived from purchased goods and services, must set targets on their Scope 1 and Scope 2 emissions

Action plan per target Scope 1

Consolidation and energy efficiency upgrades in the building portfolio, energy efficiency investments, de-commissioning of gas-fired boilers and de-commissioning of vehicle fleet Scope 2

Moving office space and data centres to renewable energy, including through the move of Euronext’s Core Data Centre Scope 3

Implementation of sustainable travel programme Supplier engagement

Actively establishing and executing a supplier engagement program aimed at achieving our SBTi supplier engagement target. The initiative includes the implementation of supplier incentives, a specialized training program, and effective communication strategies 2

FOR OUR CLIENTS: Deploy a full suite of climate-focused products and services, facilitating the European trajectory towards sustainable growth.Launched +440 ESG indices Leading venue for ESG bonds My ESG Profile • Euronext Biodiversity Enablers index, 1st world benchmark index on biodiversity

• ESG versions of its benchmark indices, including the CAC® 40 ESG, MIB ESG, AEX® ESG, BEL® ESG, and OBX® ESG, CAC SBT 1.5

• N°1 worldwide listing venue for ESG bonds in 2023, with almost 500 new bond listings

• N°1 global venue for ESG bond issuers and amount raised, with +2,200 ESG bonds, from +500 issuers, accounting for +1.3tn€

• 1st stock exchange to make standardized ESG data of its issuers available

• +1,900 company ESG profiles containing +60,000 data points on Euronext Live

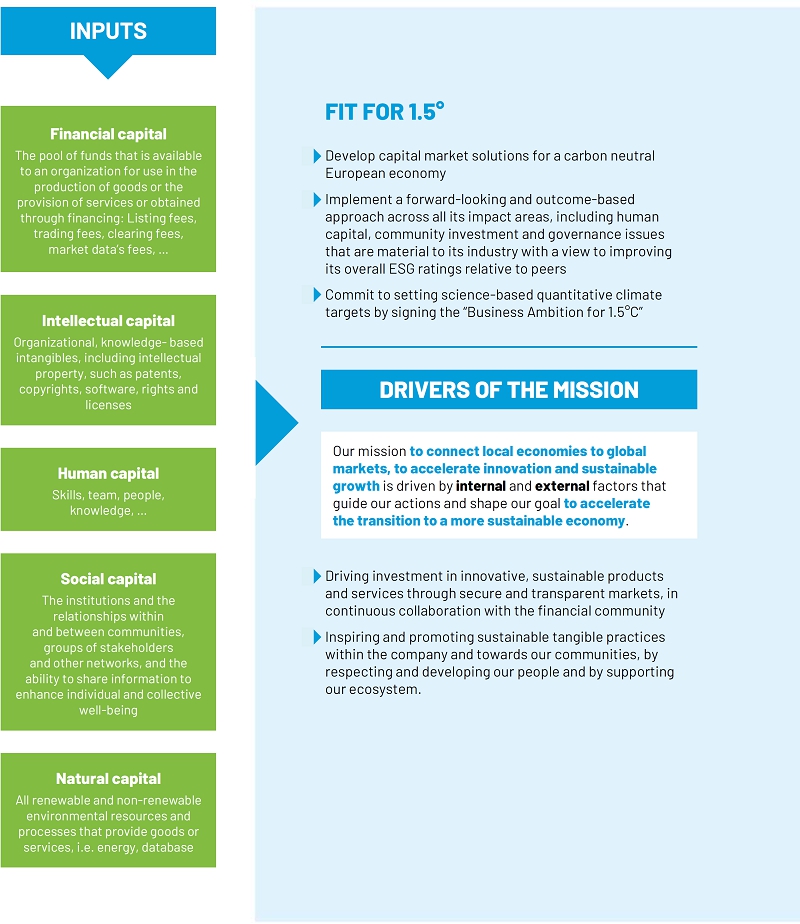

Driving investment in innovative, sustainable products and services

through secure and transparent markets, in continuous dialogue between the players of the financial community

Inspiring and promoting sustainable tangible practices

within the company and towards our communities, by respecting and developing our people and by supporting our ecosystem

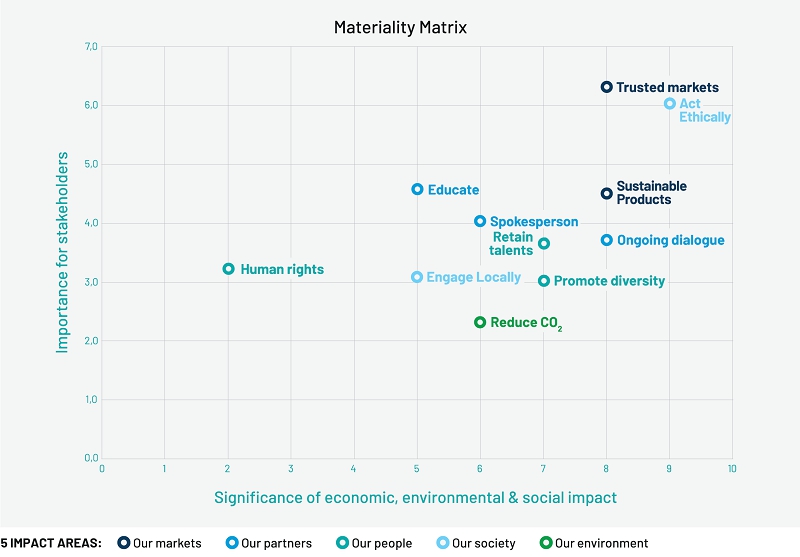

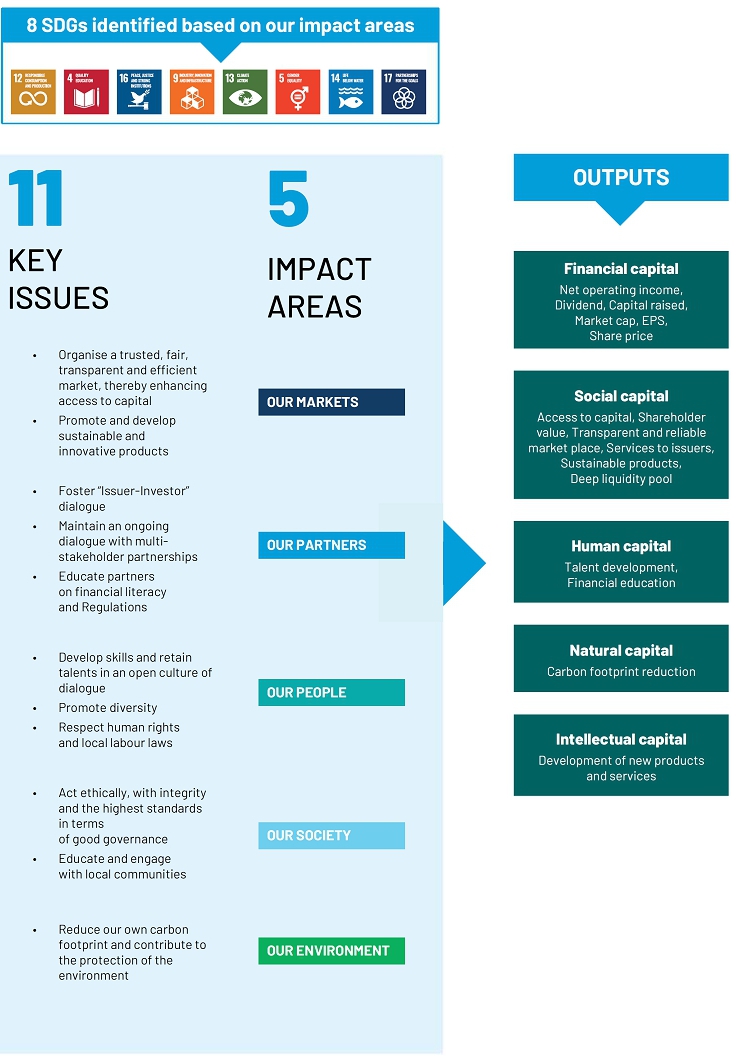

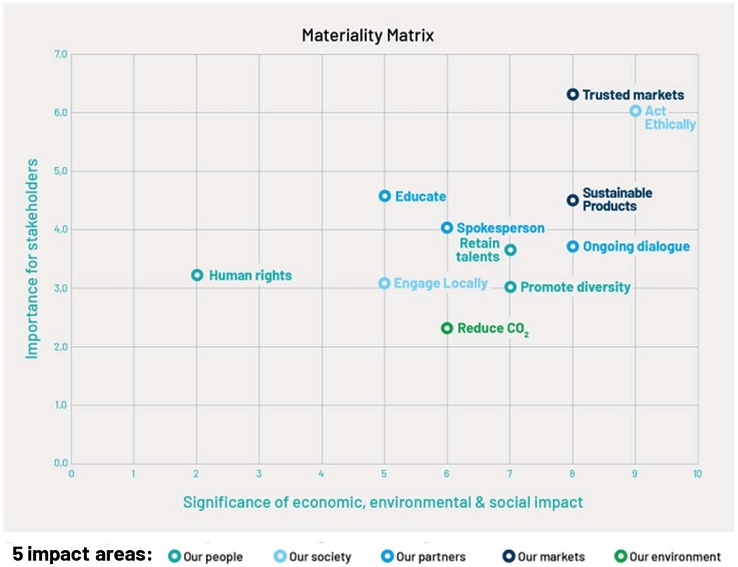

Euronext conducted a stakeholder consultation in 2018 and 2019 to identify its material ESG issues. Based on the results, eleven key issues were defined and grouped into five material impact areas, ranking them in terms of their importance to stakeholders and the ESG impact they could have. These are illustrated in the below materiality matrix.

Additionally, in 2023, Euronext launched a new stakeholder engagement initiative to conduct a double materiality assessment in accordance with the European Corporate Sustainability Reporting Directive (further information in section 3.1).

BUSINESS MODEL

Euronext’s mission: to connect local economies to global markets, to accelerate innovation and sustainable growth

Euronext ESG focus: to accelerate the transition to a more sustainable economy

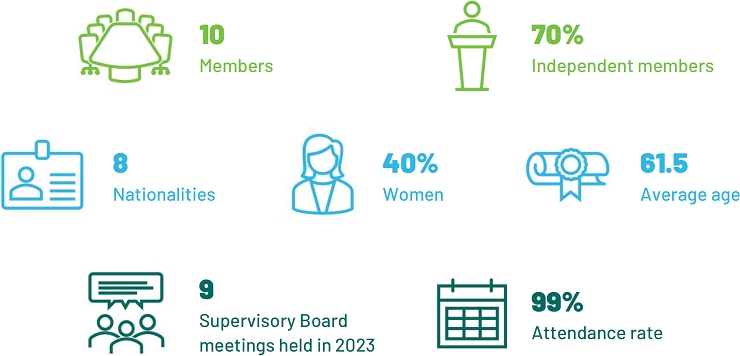

Committees of the Supervisory Board Independent Audit Risk Remuneration Nomination

& GovernancePiero Novelli

Chair58

● Chair Dick Sluimers

Vice-Chair70

Chair ● Nathalie Rachou 66

Chair ● Morten Thorsrud 52

● Chair Rika Coppens 51

● ● Manuel Ferreira Da Silva 66

● ● Padraic O’Connor 74

● ● Alessandra Ferone 53

● ● Olivier Sichel 56

Diana Chan 69

● ● ● ● Name Position

Stéphane Boujnah 59

CEO and Chairman of the Managing Board

Delphine D’Amarzit 50

CEO Euronext Paris

Fabrizio Testa 55

CEO Board Italiana and Head of Fixed Income Trading

Simone Huis In’t Veld 53

CEO Euronext Amsterdam

Simon Gallagher

Appointment subject to shareholders approval in May 202450

CEO Euronext London and Head of Global Sales

Øivind Amundsen 56

CEO Oslo Børs

Isabel Ucha 58

CEO Euronext Lisbon

Daryl Byrne 52

CEO Euronext Dublin

Benoît van den Hove 48

CEO Euronext Brussels

Manuel Bento 49

COO Senior management Role Senior management Role Giorgio Modica 50

Group CFO Angelo Proni 57

CEO of MTS Sylvia Andriessen 58

General Counsel Mathieu Caron 45

Head of Primary Markets Camille Beudin 39

Head of Diversified Services Aurélie Cohen 36

Chief Communications and Investor Relations Officer Amaury Houdart 48

Chief Talent Officer Pierre Davoust 37

Head of CSDs Tatyana Valkova 40

Head of Compliance and Risks Daniela Melato 47

Head of Group Data Services Anthony Attia 49

Global Head of Derivatives and Post-Trade Nicolas Rivard 46

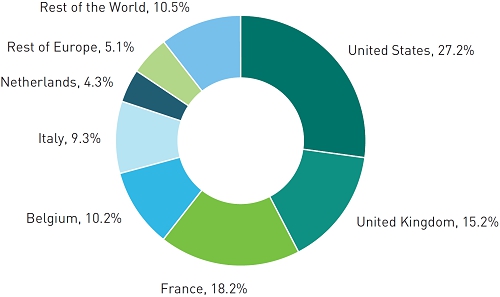

Global Head of Cash Equity and Data Services (b) Treasury shares include shares acquired as part of the share repurchase programme, carried between 31 July 2023 and 4 January 2024, which will be cancelled

Name of reference shareholder Number of

sharesIndividual

shareholding

(% of capital)Caisse des Dépôts et Consignations 7,840,000 7.32% CDP Equity 7,840,000 7.32% Euroclear S.A./N.V. 4,284,252 4.00% Société Fédérale de Participations et d’Investissement/ Federale Participate- en Investeringsmaatschappij 3,391,200 3.17% Intesa SanPaolo 1,606,594 1.50% ABN AMRO Bank N.V. through its subsidiary ABN AMRO Participaties Fund I B.V. 539,000 0.50% TOTAL SHAREHOLDING (a) 25,501,046 23.81% On 8 March 2024, an announcement was published confirming that Société Fédérale de Participations et d’Investissement, Caisse des Dépôts et Consignations and CDP Equity agreed with Euroclear S.A./N.V. to acquire from Euroclear respectively 2,142,126, 535,531 and 535,531 shares in the share capital of Euronext N.V., representing respectively 2.0%, 0.5% and 0.5% of the share capital of the Company.

Euronext shares are listed on Euronext Amsterdam, Euronext Brussels, Euronext Lisbon and Euronext Paris since June 2014.

- Postal Address: Beursplein 5, NL-1012 JW Amsterdam, Netherlands

- Phone: +31 (0)20 72 14 400

- https://www.euronext.com

- Website: https://www.euronext.com/en/investor-relations

- Email: ir@euronext.com

- Postal Address: 14 place des Reflets, 92054 Paris La Défense Cedex, France

- Phone: +33 (0)1 70 48 24 17

Euronext is part of more than 140 indices, including the CAC Next 20, SBF 120, MSCI Standard Series, Stoxx 600 Financial Services, Euronext Equileap Gender Equality France 40 and CAC SBT 1.5

-

1. PRESENTATION OF THE GROUP |DR|

1.1 Company Profile

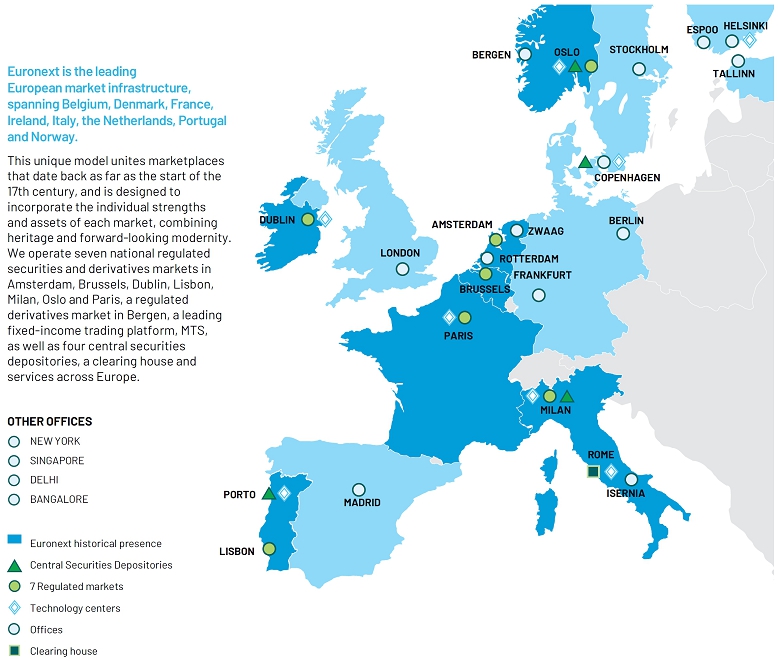

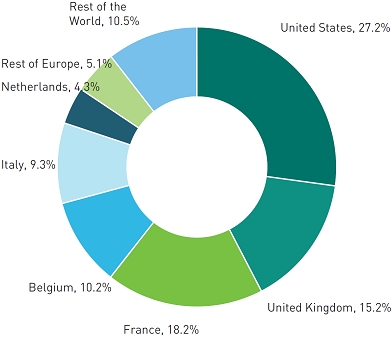

Euronext N.V. is a Dutch public company with limited liability (naamloze vennootschap) with its registered office in Amsterdam. the Netherlands, Euronext N.V. is registered with the trade register of the Chamber of Commerce for Amsterdam, the Netherlands, under number 60234520. Euronext N.V. has its main subsidiaries in Belgium, Denmark, France, Ireland, the Netherlands, Norway, Portugal, Italy, the United Kingdom and the United States. Euronext N.V. has diversified its activities and services offering through selected acquisitions (please refer to section 1.1.1 - History) and expanded its European federal model, with the acquisition of 100% of the Irish Stock Exchange on 27 March 2018, 100% of Oslo Børs VPS on 4 July 2019, 100% of VP Securities, in Copenhagen, on 4 August 2020 and 100% of London Stock Exchange Group Holdings Italia S.p.A. (renamed Euronext Holding Italia S.p.A. after the acquisition) and its subsidiaries (Borsa Italiana Group) on 29 April 2021.

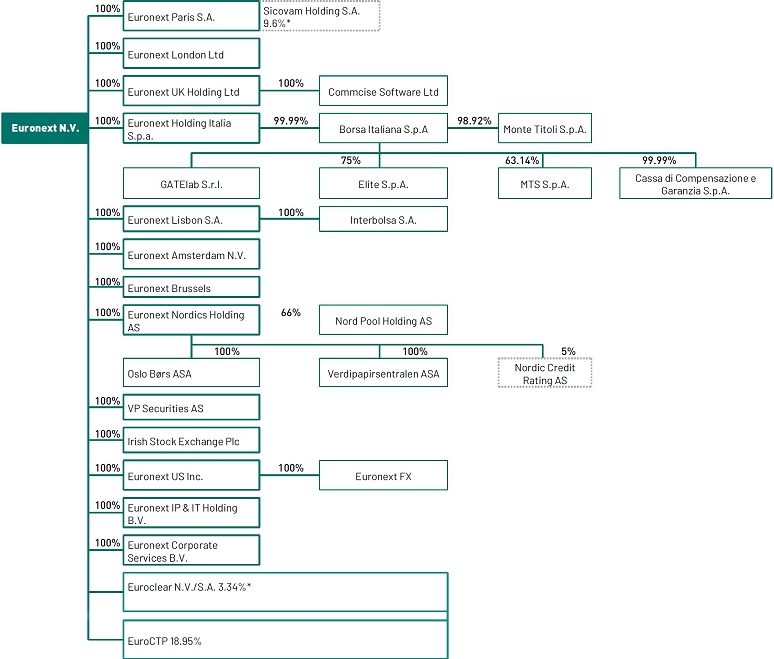

Euronext was incorporated under the name Euronext Group N.V. on 15 March 2014 in the context of a demerger of Euronext N.V., which was a company owned by ICE. Euronext Group N.V. changed its name to Euronext N.V. on 2 May 2014. The following chart provides an overview of Euronext N.V. main entities as of 31 December 2023. Percentages refer to both share of capital and voting rights.

1.1.1 HISTORY

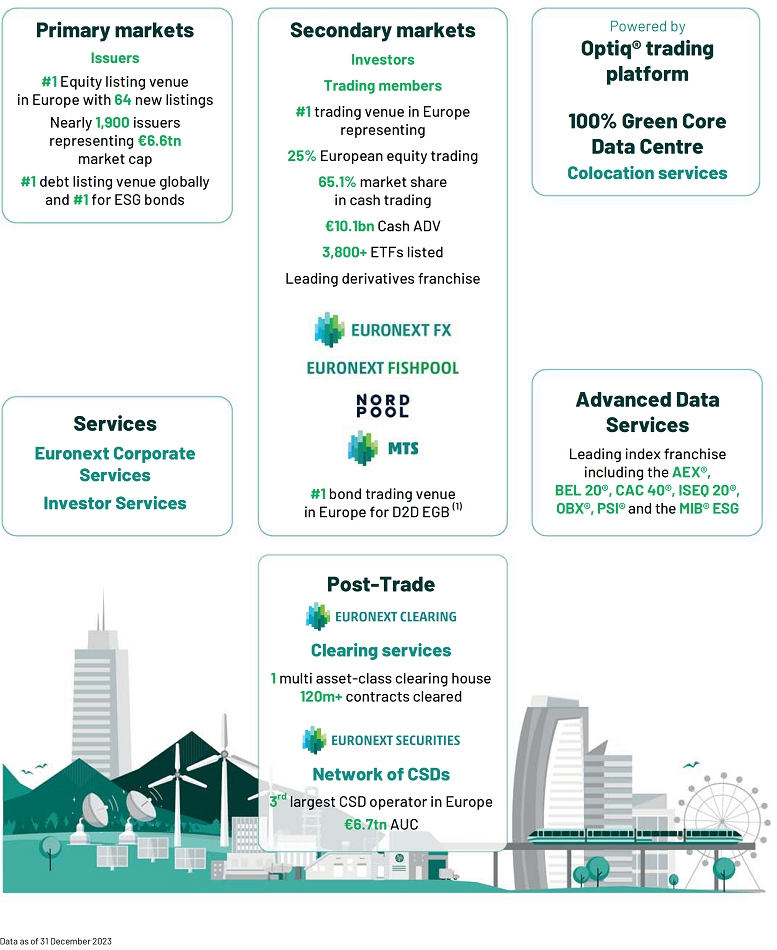

Today, Euronext is the leading pan-European market infrastructure, offering a diverse range of products and services across the value chain and notably operating transparent and efficient equity, fixed income securities and derivatives markets in Amsterdam, Brussels, Dublin (since March 2018), Lisbon, Milan (since April 2021), Oslo (since June 2019) and Paris. Euronext’s businesses comprise equity, debt, fund and ETF listing, corporate and investor services, cash trading, foreign exchange trading, derivatives trading, fixed income trading, power trading, advanced data services and post-trade services (including clearing across Euronext markets and custody and settlement in Denmark, Italy, Norway and Portugal) as well as technology solutions. As of the end of December 2023, Euronext has close to 1,930 listed equity issuers totalling around €6.6 trillion in combined market capitalisation, positioning it as the largest equity listing venue in Europe, and attracting the majority of listings from domestic and international companies in Europe. The Group is also the leading bond and ESG bond listing venue globally with over 55,000 bonds listed. Further, Euronext is the largest equity lit trading venue in Europe, processing over 25% of on-exchange lit trading flows in 2023. On the seven national markets it operates, the Group reported on average a 65.1% market share on cash equity lit trading. Euronext is about to be present on the full trading value chain, ranging from listing to custody and settlement, following the clearing migration in 2023 and its second phase planned for 2024.

Euronext in its original form was created in 2000 and takes its roots from the European construction. It began as the result of a three-way merger of the Paris, Amsterdam and Brussels exchanges, which were combined into a unique federal model with unified rules and a Single Order Book, operating on the same electronic trading platform and cleared by LCH S.A. central counterparty (CCP). This created the first genuinely cross-border exchange in Europe, pre-dating all initiatives by policy makers to allow for the creation of pan-European market places. This was complemented soon after by the acquisition of the London-based derivatives market, LIFFE, and the merger with the Portuguese exchange.

In May 2006, Euronext entered into an agreement with NYSE group for the combination of their respective businesses. The new holding company of these combined businesses, NYSE Euronext, was subsequently listed on the New York Stock Exchange and on Euronext Paris.

In 2010, NYSE Euronext launched Euronext London, a London-based securities market aiming at attracting international issuers looking to list in London and benefit from Euronext’s value proposition1.

In November 2013, ICE, an operator of global markets and clearing houses, acquired NYSE Euronext. A key element of the overall transaction was the separation and IPO of NYSE Euronext’s continental European exchanges as a stand-alone entity. In order to do this, ICE carved out the continental European operations of NYSE Euronext and Euronext London into a newly formed entity, which was subsequently renamed Euronext N.V. Since its successful IPO on 20 June 2014, Euronext N.V. has been an independent listed company.

In May 2016, Euronext N.V. launched its strategic plan named “Agility for Growth” which defined its growth ambitions for 2019, both through organic growth and bolt-on acquisitions. In 2017, Euronext N.V. diversified its revenue, through the acquisition of 90% of the shares of the spot forex platform FastMatch (subsequently renamed Euronext FX), and by investing in corporate services companies.

In 2018, Euronext N.V. expanded its listing franchise, welcoming a new exchange to its federal model with the acquisition of the Irish Stock Exchange, now Euronext Dublin. The Group also strengthened its Corporate Services offering with the acquisition of InsiderLog and widened its product offering with the launch of Investor Services through the acquisition of Commcise in December 2018.

In 2019, Euronext N.V. pursued the expansion of its federal model with the acquisition of Oslo Børs VPS, strengthening its capital markets footprint and its post-trade franchise and marking the first step in its Nordic expansion ambitions. In October 2019, Euronext launched its strategic plan, “Let’s Grow Together 2022” under which Euronext built the leading pan-European market infrastructure, and which targets have been achieved two years in advance.

In 2020, Euronext N.V. pursued both its Nordic and federal model expansion. The Group acquired a majority stake in Nord Pool, a leading power trading infrastructure operating in the Nordic region, Baltics and the Central and Western Europe region, widening its range of asset classes. The Group also strengthened its post-trade offering with the acquisition of VP Securities, now Euronext Securities Copenhagen, the Danish domestic CSD, and expanded its corporate services franchise with the acquisition of Troisième Sens and Ticker.

In 2021, Euronext N.V. pursued both its federal model and asset class expansion with the transformational acquisition of 100% of the issued share capital of London Stock Exchange Group Holdings Italia S.p.A., the holding company of the Borsa Italiana Group. The transaction, which was completed on 29 April 2021, significantly enhances the scale of Euronext, diversifies its business mix into new asset classes and strengthens its post-trade activities, especially in clearing. In November 2021, Euronext N.V. launched its new strategic plan “Growth for Impact 2024”, which sets out the Group’s ambition to build the leading market infrastructure in Europe. Under this plan, Euronext N.V. will continue to pursue its mission to connect European economies to global capital markets, to accelerate innovation and sustainable growth. The Group aims to make an impact on its industry and its ecosystem to shape capital markets for future generations.

In 2023, Euronext N.V. delivered on significant milestones of its “Growth for Impact 2024” strategic plan. Euronext successfully completed the migration of the cash markets of Borsa Italiana to Euronext’s state-of-the-art trading platform Optiq®. This paved the way for the expansion of Euronext Clearing to Euronext Amsterdam, Brussels, Dublin, Paris, and Lisbon cash markets. These two major projects contributed to the €74 million synergies delivered as of end of 2023.

The Borsa Italiana Group integration programme is well advanced and has allowed Euronext to upgrade its 2024 cumulated run-rate annual EBITDA synergy target since the closing of the Borsa Italiana acquisition in April 2021 to €115 million, representing twice the amount announced in October 2020, when the acquisition was first announced (€60 million).

-

1.2 Strategy: “Growth for Impact 2024” Strategic Plan

1.2.1 “GROWTH FOR IMPACT 2024”, A PATH TO BUILD THE LEADING MARKET INFRASTRUCTURE IN EUROPE

Since its initial public offering (IPO) in 2014, through optimal resource allocation and cost control, as well as stronger development of underexploited businesses, Euronext has strived to deliver its solutions for the real economy.

Following the delivery of its IPO objectives a year in advance, in May 2016 Euronext published its strategic plan, “Agility for Growth”, outlining its growth ambitions to 2019. Euronext achieved most of its “Agility for Growth” ambitions one year in advance, and announced in October 2019 its next strategic plan, “Let’s grow together 2022”, introducing its growth ambition to 2022. Under this plan, Euronext has successfully delivered its ambition to become the leading pan-European market infrastructure, through a combination of organic growth, the acquisitions of Nord Pool1 and VP Securities (Euronext Securities Copenhagen), and the transformational acquisition of the Borsa Italiana Group. Euronext achieved its 2022 financial targets two years in advance in 2020, thanks to strong organic revenue growth.

Euronext now operates seven national markets, four central securities depositories (CSDs) and one multi-asset clearing house in Europe, as well as various trading infrastructures, giving it the ability to manage the entire capital markets value chain for the first time since its IPO. Euronext can now more than ever be bold and strategically ambitious, leveraging its strengths and greater scale to deliver on its new ambition: build the leading market infrastructure in Europe.

In November 2021, Euronext released its three-year strategic plan, “Growth for Impact 2024”. Under this plan, Euronext intends to grow and leverage its scale for the benefit of its clients, team members, shareholders and stakeholders. Euronext’s mission is to connect European economies to global capital markets, to accelerate innovation and sustainable growth.

“Growth for Impact 2024” sets out the Group’s ambition to build the leading market infrastructure in Europe. The Group aims to make an impact on its industry and its ecosystem fulfilling its purpose to shape capital markets for future generations.

■ Leverage Euronext’s integrated value chain, through the European expansion of CC&G (renamed Euronext Clearing) clearing activities, the Core Data Centre migration to the European Union, and the international expansion of MTS; ■ Pan-Europeanise Euronext CSDs through the expansion of services across its four CSDs in Portugal, Norway, Denmark and Italy, the harmonisation of processes and enhancement of the client experience; ■ Build upon Euronext’s leadership in Europe, to further develop its leading listing and trading venues, to accelerate the delivery of innovative products and services thanks to technology, and to scale up advanced data services, corporate and investor services; ■ Empower sustainable finance through an ambitious climate commitment for Euronext that aims to make a tangible impact on its partners and clients, with the launch of the Fit for 1.5° climate commitment, and also through an enhanced inclusive people strategy; and ■ Execute value-creative M&A by continuing to seek external diversification opportunities, in line with Euronext’s strict investment criteria and its commitment to maintain an investment grade rating. Euronext was, until 2021, the only market infrastructure that did not directly manage its clearing activities for its listed derivatives markets. Since 2003, Euronext has relied on a third-party clearing house, LCH S.A., for the clearing of most of its cash and derivatives trading flows on its markets, with a revenue sharing agreement. Euronext has proposed on various occasions to take control of LCH S.A., unsuccessfully. Today, for the first time, thanks to the acquisition of Euronext Clearing in April 2021, Euronext is the owner of a multi-asset clearing house and is thus in a position to directly manage its clearing activities to complete its value chain. Euronext is determined to directly manage the clearing of its cash and derivatives flows. Therefore, it decided to expand Euronext Clearing clearing activities across Europe3.

Euronext is making Euronext Clearing Euronext’s central counterparty (CCP) of choice for its cash equity, listed derivatives and commodities markets in Europe. Euronext continues to offer an open access CCP model for cash equity clearing.

Euronext is positioning Euronext Clearing as a European clearing house. Euronext Clearing was enhanced with a new Value at Risk framework. Euronext Clearing will be reinforced by cutting-edge technology in line with its new international ambitions. The European clearing organisation has teams in Italy and France.

This strategic ambition allows Euronext to directly manage another core service for clients and create value through a harmonised clearing framework across Euronext venues. It will allow Euronext to align strategic priorities between trading and clearing, and significantly increase its footprint in the post-trade space. In addition, Euronext will be in an ideal position to innovate and improve time-to-market, notably on derivatives products, to serve the evolving needs of its clients. Revenue and costs contribution for this key project are part of the increased Borsa Italiana Group synergies target. Similarly, the necessary one-off costs to execute this project are included in the 2024 guidance4.

In January 2023, Euronext sent notice of termination to LCH S.A. for its derivatives clearing agreements and confirmed the expansion of Euronext Clearing to listed derivatives and commodities markets for the third quarter of 2024. In November 2023, Euronext Clearing was expanded as the CCP of choice for Euronext cash markets in Amsterdam, Brussels, Dublin, Lisbon and Paris.

Euronext announced in April 2021 the strategic decision to migrate its Core Data Centre from Basildon, in the United Kingdom, to Bergamo, in Italy.

The migration is a response to multiple factors, including the dynamic created by Brexit and a strong rationale to locate the Group’s Core Data Centre in a European Union country where Euronext operates a large business. This transformative move, managed in collaboration with clients, marks a milestone in bringing back to the European continent the data centre that handles 25% of European trading volumes.

This migration allows Euronext to fully control and directly manage its core IT infrastructure, and a key service to clients, which was previously outsourced. This also allows the generation of colocation revenues, embedded in the upgraded synergies. Clients are benefitting from a state-of-the-art colocation facility. Since this data centre is 100% powered by renewable energy sources, clients see their own carbon footprints reduced.

The Group Core Data Centre migration was completed in June 2022. This migration was timed to be ready for the migration of the Borsa Italiana equity and derivatives markets onto the Optiq® trading platform in 2023 and 2024.

Borsa Italiana joined the Euronext central order book, which offers a unique gateway to investors accessing the largest liquidity pool in Europe. This single liquidity pool is powered by Optiq®, Euronext’s proprietary state-of-the-art technology, offering a unique entry point to Euronext’s securities and products for both local and global institutional investors and for retail investors. Issuers are benefiting from this increased visibility towards international investors, while Italian brokers and investors will benefit from a single access point to trade the securities of seven European countries.

Borsa Italiana cash markets migrated to the Optiq® trading platform in 2023, and the migration of derivatives is targeted for Q1 2024.

2 Subject to regulatory approvals

3 Subject to regulatory approvals

4 To highlight its underlying performance, since Q1 2022 Euronext is adjusting its operating expenses and publishes an adjusted EBITDA excluding non-recurring item’s such as implementation costs for the strategic projects announced. For more information on the guidance see 1.2.3 - Strategic Targets and Prospects in 2023.

MTS is the leading fixed income trading platform in Europe, number one in Europe for Dealer-to-Dealer (D2D) European Government bonds trading, number one in Italian repo trading and number three in Europe for Dealer-to-Client (D2C) European Government bonds trading. As part of its mission to finance the real economy, Euronext has proposed to the European Commission the use of the MTS platform for the secondary market, and transparent negotiation, of bonds issued within the NextGenerationEU recovery programme.

Euronext will strengthen its leading position in D2D, through extended geographical reach and an expanded offering with new services. Its buy-side reach will be expanded through MTS BondVision together with the deployment of an added-value data offering. MTS will expand across the full value chain, by exploring opportunities to deploy new and existing solutions to meet the needs of its clients.

The European Union has recognised MTS EU as an interdealer platform for the implementation of electronic market making on European Union issued debt instruments. This new market was launched very successfully in November 2023.

The incremental revenue from MTS’s expansion strategy is included in the €115 million Borsa Italiana Group targeted synergies.

II. Pan-Europeanise CSDs through the expansion of services, the harmonisation of processes and enhancement of the client experience

Euronext operates a leading CSD network representing €6.7 trillion in assets under custody, 120 million yearly settlement instructions and more than 7,700 issuers5. The Group is now the third-largest CSD operator in Europe. Euronext has combined its four CSD brands into Euronext Securities, a new umbrella brand for its CSD business, while keeping a strong local presence and identity.

This new positioning will help Euronext gain new business and diversify its activity in Europe through the expansion of added-value services for financial institutions such as tax reporting services, compliance, data products and asset servicing. Euronext will also make new services available to issuers, especially SMEs, leveraging its fully digital issuance capabilities.

Euronext Securities will also streamline processes to better serve local and international customers, gradually mutualising its infrastructure, applications, and functionalities to facilitate access to the local markets served by Euronext Securities and to support Euronext issuance and trading businesses across Europe.

Finally, Euronext will roll out new targeted client interfaces and a client service model addressing the needs of both local and global clients.

Euronext is the leading equity listing venue in Europe with close to 1,930 issuers representing €6.6 trillion of aggregated market capitalisation6. Euronext is also the world’s leader in debt listing with more than 55,000 listed securities7.

Euronext’s size makes it by far the largest liquidity pool in Europe, providing an integrated “one-stop-shop” for local and global issuers, to cover their equity and debt financing needs, and corporate services.

Building on its geographic expansion, with the recent additions of the Irish, Norwegian and Italian markets, Euronext will continue to expand its pan-European reach and will welcome top international issuers, leveraging its unique liquidity pool and sectorial strengths.

With close to 1,500 SMEs listed on Euronext markets, the Group is committed to financing the real economy and will further simplify access to equity and bond financing by increasing the competitiveness of its listing venues. Euronext will expand Borsa Italiana’s STAR segment and grow the ELITE network to deepen its relationships with SMEs. Euronext’s successful pre-IPO programmes will be strengthened, notably with specific ESG modules to support issuers in their ESG transition and to comply with non-financial disclosure requirements. Euronext is Europe’s leading venue for Technology companies, with over 700 issuers listed on its markets across clean technologies, life sciences, technology, media and telecom (TMT), bio-technologies, medical technologies, and other sectors. Euronext will continue to grow this franchise, notably by continuing to invest in dedicated pre-IPO programmes, such as IPOready, which now counts over 920 alumni and more than 80 partners. Euronext has launched in June 2022 Euronext Tech Leaders initiative, including a segment and index dedicated to highlighting the visibility and attractiveness of high-growth listed Tech companies among international investors, together with a suite of services to support them through their financial journey. Alongside this segment, Euronext plans to launch a full suite of pre-IPO services to attract private Tech listing candidates to Euronext’s markets, supporting their growth financing needs.

Euronext has the ambition to become the leading global ESG financing venue, and the partner of choice for issuers in the sustainable transition. The Group has launched My ESG Profile, making individual data of issuers available on the Euronext website in a standardised form, using more than 60,000 ESG data points. Euronext has also expanded ESG bonds to track the 1.5-degree ambitions of ESG bond issuers, flagging taxonomy-eligible issuers to increase their visibility to investors. Please refer to section 3 - Empower Sustainable Finance for more details.

Capitalising on accelerated trends towards digitalisation, Euronext Corporate Services has successfully delivered 24% revenue compound annual growth rate (CAGR) between 2018 and 2021, and it now serves over 4,800 clients in 30 countries, spanning listed and private companies, as well as public sector entities. Euronext Corporate Services has transformed several single-product companies into a pan-European multi-product business, supporting clients’ needs in compliance, communication, governance, and investor relations. Euronext will continue to grow Corporate Services further by consolidating its position in core domestic countries, growing internationally in new strategic markets, and continuously developing the portfolio of solutions, with a specific focus on Compliance.

Euronext operates seven regulated markets and is the number one European cash equity trading venue, with €10.1 billion of cash average daily volumes (ADV)8, representing a quarter of European lit volumes. Euronext has shown a unique track record in the management of cash trading market share and value extraction. Euronext has leveraged its unified markets with a standardised approach across Europe, while protecting local specificities and ecosystems. Euronext wishes to consolidate its European scale and maximise touchpoints upstream in the value chain. This strategy, combined with the Core Data Centre migration, the migration of Borsa Italiana capital markets to Optiq® and the European expansion of Euronext Clearing clearing activities, aims to build the launchpad for an integrated European market.

Euronext aims to continue to be the most liquid and largest trading venue in Europe, and to extract superior value from cash trading activities. It will develop a new generation of pricing strategies, built on its years of expertise, to support yields and market quality. It will continue to support diversity of flows by offering a trading model that meets the needs of both local and global players to offer a best-in-class trading experience for retail and institutional investors.

The derivatives franchise will be strengthened by expanding to new geographies and leveraging Borsa Italiana markets, and by developing more ESG-related products. The European expansion of the Euronext Clearing clearing operations will give Euronext the flexibility to develop products to meet client demand quickly and efficiently.

Euronext offers its clients the option of exposure to crypto-assets through a suite of new products. After the recent success of the listing of cryptocurrency exchange traded products (ETPs) on Euronext, the Group will continue to expand its crypto-tracking ETP offering. Euronext proposes a new family of Euronext branded crypto-indices to support the launch of related products. Moving forward, Euronext will provide its clients with exposure to crypto-assets with the same level of regulatory security and operational efficiency as on Euronext’s core markets.

Euronext’s Advanced Data Services business will scale up by leveraging the most comprehensive cash equity data in Europe, its fast-growing index franchise, and new datasets from recent acquisitions. Euronext aims to become the number one European ESG index provider, leveraging national brands, strong local presence and its ecosystem of innovative ESG data partners (refer to section 3 - Empower Sustainable Finance for more details). Euronext will build on recent successes to further deepen its relationship with exchange traded fund (ETF) issuers and asset owners. It will take its data analytics offering to the next level by building on leading quant capabilities and the most advanced data products tailored to end-user client segments. And Euronext will also monetise non-public proprietary data and extend its expertise to new datasets from recently integrated businesses, such as fixed income.

Euronext will support the evolving use of market data and adapt its product suite and commercial policies to new usage demands. It will leverage technology, both cloud and digital, to transform data servicing and data distribution, benefiting from the Group’s new scale.

Euronext continually develops its existing architecture and ensures business scalability using cloud, microservices and application programming interface services. Harmonisation of its infrastructure, especially across Euronext’s CSD network, will permit further efficiencies. Euronext will also harness data science to develop innovative solutions, products and services.

Euronext has consistently invested in resiliency and platform stability, and its proprietary Optiq® trading platform handled trading volatility peaks seamlessly in 2020, 2021 and 2022. To continuously improve the monitoring of its IT systems along the trading chain, Euronext has developed a set of best practices supported by a comprehensive data-driven operational risk framework.

Euronext has significantly invested in and improved its crisis management framework. It performs regular stress training, relying on a robust playbook for decision-making and a comprehensive crisis communication plan. In the years to come, Euronext will continue to invest to deliver best-in-class resiliency and stability for its platform, while offering new services and products. Furthermore, Euronext will extend the use of artificial intelligence to improve data analysis and infrastructure agility.

Customer satisfaction is at the centre of Euronext’s strategy. Investment in enhanced digital tools will allow the Group to offer a better and more unified customer experience.

IV. Empower sustainable finance through an ambitious environmental, social, and governance (ESG) strategy

The world has entered a decisive decade for the achievement of the objective of the Paris Agreement to keep the global temperature increase at well below 2 degrees compared to pre-industrial levels. Urgent action is required now, from companies and from the financial sector more broadly, to avoid the negative effects of climate change.

Against this backdrop, Euronext is leveraging its ESG performance to build an impactful ESG strategy. The new sustainability strategy focuses on accelerating climate action both in Euronext’s operations and through the role it plays in empowering sustainable finance across all its markets.

Euronext is proud to announce the launch of its “Fit for 1.5°” climate commitment, for itself, its partners and its clients.

Euronext has set science-based quantitative climate targets by signing the “Business Ambition for 1.5°C”, a campaign led by the Science Based Targets initiative (SBTi)9 in partnership with the United Nations Race to Zero campaign.

Applying the SBTi methodology to Euronext emissions led to the formulation of the following targets that have been validated by SBTi in February 2023:

■ By 2030, Euronext will reduce its Scope 1 and Scope 2 market-based greenhouse gas emissions by 73.5% compared to 2020; ■ By 2030, Euronext will reduce its scope 3 business travel emissions by at least 46.2% compared to 2019; ■ By 2027, Euronext suppliers, representing 72% of Euronext’s greenhouse gas emissions derived from purchased goods and services, must set targets on their Scope 1 and Scope 2 emission. The relocation of Euronext’s Core Data Centre to a green facility has been the first move to follow through on this transformational commitment. The new data centre is powered 100% by renewable energy sources, much of which is self-produced through solar panels and hydroelectric power stations. The migration to a sustainable data centre sets the standard for the industry and provides clients with concrete tools to improve their own carbon footprint.

Furthermore, Euronext is developing services and products to accelerate the transition to a European economy aligned with a 1.5-degree trajectory. This will help drive investment towards decarbonised assets and support Euronext’s clients on their ESG journey. Solutions supporting the strategy include, among others, the creation of a climate transition market segment, dedicated to issuers committed to science-based targets, the creation of climate and ESG versions of Euronext’s national benchmark indices, revised ESG reporting guidance for issuers focusing on climate, and low-carbon colocation services.

Euronext will complement this environmental focus by implementing a forward-looking and outcome-based approach across all its impact areas, including human capital, community investment and governance issues that are material to its industry with a view to improving its overall ESG ratings relative to peers.

Euronext is diverse by nature and by commitment, with 63 nationalities across 18 countries, and a genuinely inclusive culture, embedded in its federal model. The Euronext Managing Board, Senior Leadership Team and Supervisory Board have reached their gender diversity targets in two years, with 30%, 30% and 40% gender diversity respectively already delivered. Euronext will go further, and will reach a 30% target in average on local Boards by 2024 and has extended its 30% targets to the management levels below the Senior Leadership Team in 2023.

Building on the success of Euronext’s Diversity Day and International Women’s Day initiatives, each Euronext country has taken the commitment to reinforce local diversity partnerships with schools and recruitment providers, as well as early mentoring programmes as part of the Group’s financial literacy initiatives. Euronext sees all forms of diversity, including disability, gender, sexual orientation, age, and cultural background, as a key success factor of its federal model, and is committed to further improve diversity practices in the next three years. This commitment will be reinforced in all its people practices through its people integration programme across Europe.

Euronext will pursue its growth strategy through high value-added acquisitions aimed at diversifying and strengthening the business profile of the Group, with a specific focus on Europe.

Euronext will maintain a rigorous investment policy, with a targeted return on capital employed (ROCE) of acquisitions above weighted average cost of capital (WACC) between years 3 to 5. As a key market infrastructure, Euronext expects to maintain its investment grade while leveraging its financial flexibility to capture market opportunities that arise. On 9 February 2023, Euronext has been upgraded by S&P to a BBB+ rating.

Euronext’s growth ambition is reflected in the 2024 financial targets and a rigorous capital allocation strategy.

■ Revenue is expected to grow by +3% to +4% CAGR2020Proforma-2024E, excluding potential acquisitions, driven by (i) organic growth, especially in services, and (ii) growth initiatives related to Borsa Italiana integration. ■ EBITDA is expected to grow by +5% to +6% CAGR2020PF-2024E, excluding potential acquisitions, driven by (i) continued best-in-class cost discipline, (ii) investments in operational excellence and (iii) uplift profitability of already-acquired companies to Euronext’s level. ■ Euronext expects to achieve €115 million of run-rate pre-tax synergies related to the Borsa Italiana Group acquisition by 2024 (€100 million previously announced on November 2021), up c. 92% compared to the €60 million of synergies announced at the time of the acquisition in April 2021, to incur €150 million of non-recurring implementation costs (€160 million previously announced on November 2021). More than 60% of those synergies are related to growth projects. ■ Capex is confirmed at between 3% and 5% of revenue. ■ Dividend policy is set at 50% pay-out of reported net income. -

1.3 Description of the Business

In accordance with Article 19 of Regulation (EU) 2017/1129, the following information is incorporated by reference in the Universal Registration Document:

The description of principal activities of the Company for the financial year 2022, presented on pages 26 to 46 of the 2022 Universal Registration Document filed with the Autoriteit Financiële Markten on 31 March 2022 and available at:

https://www.euronext.com/sites/default/files/financial-event-doc/2023-08/EUR_2022_URD_MEL%20FINALE_AUG.pdf

The description of principal activities of the Company for the financial year 2021, presented on pages 24 to 43 of the 2021 Universal Registration Document filed with the Autoriteit Financiële Markten on 31 March 2022 and available at:

https://www.euronext.com/sites/default/files/financial-event-doc/2022-04/2021%20URD%20-%20ENX%20-%20PDF_1.pdf

1.3.1 BUSINESS OVERVIEW

Euronext is the leading pan-European market infrastructure offering a diverse range of products and services and combining transparent and efficient equity, fixed income securities and derivatives markets in Amsterdam, Brussels, Dublin, Lisbon, Milan, Oslo and Paris. Euronext operates various businesses in 18 countries. Euronext’s businesses comprise listing, cash trading, derivatives trading, spot FX trading, fixed income trading, power trading, investor services, advanced data services, post-trade, technologies & other.

Euronext is the leading listing venue in Europe and attracted 64 new equity listings in 2023. Euronext markets provide the leading listing venues in continental Europe based on the number of companies listed as of 31 December 2023. Close to 1,930 issuers representing a combined market capitalisation of approximately €6.6 trillion were admitted to trading on Euronext’s markets as at 31 December 2023. As of 31 December 2023, Euronext ranked first in Europe in terms of market capitalisation of listed companies and first among the largest exchange groups in Europe in terms of number of companies listed, excluding Bolsas y Mercados Españoles (on which a large proportion of listed issuers are open-ended investment companies, limiting comparability). In addition, the Company has over 3,800 exchange traded products (ETPs)1 and close to 2,500 funds listed on its markets as of 31 December 2023.

Euronext ranked first among all trading venues in Europe in terms of monthly lit continuous & auctions order book trading volume in equities for the last 12 months ended 31 December 2023 among all trading venues in Europe.

Euronext’s pan-European cash equities trading venue is the market leader in cash equity trading in its seven home continental European markets of Belgium, France, Ireland, Italy, the Netherlands, Norway and Portugal, as of 31 December 2023. Average Daily Value on cash trading amounted to €10.1 billion in 2023, representing around 25% of the total European lit equity trading markets. Euronext market share in cash equities trading of the securities listed on its markets reached 65.1% over 2023. Euronext provides multiple marketplaces including its Multilateral Trading Facilities (MTFs), for investors, broker-dealers and other market participants to meet directly to buy and sell cash equities, fixed income securities and exchange traded products (ETPs).

Euronext is also the number one venue for the listing of bonds globally, with over 9,700 new bond listings in 2023 and a total number of listed bonds exceeding 55,000 at the end of 2023, surpassing 2022’s total of more than 53,000 listed bonds. Bond listing is an international business activity with over 4,000 issuers coming from more than 100 jurisdictions across the globe.

1 Including exchange traded funds (ETF), exchange traded commodities (ETC) and exchange traded notes (ETN)

Euronext, with its regulated markets (in Paris, Brussels, Milan, Amsterdam, Lisbon) and MTFs (EuroTLX, ExtraMOT, Growth, Access, GEM) is a leading European platform for the electronic trading of fixed income securities in retail size / odd-lots. In 2023, average daily volume for retail fixed income trading on Euronext markets reached €1.3 billion.

Euronext’s derivatives trading business has a strong market position in futures and options on benchmark indices such as the CAC 40®, AEX®, BEL 20®, ISEQ®, OBX® and PSI® and FTSE® MIB, single stock options and futures and commodity derivatives. It ranks second among European exchange groups in terms of open interest of derivatives traded as at 31 December 2023. Euronext offers options contracts based on all of the blue-chip equities listed on Euronext, thereby reinforcing liquidity for those equities. This includes the components of Euronext’s flagship national indices such as the CAC 40®, the second most traded national index in Europe. The commodity derivatives offered by the derivatives trading business include the milling wheat futures contract which is a world-class contract for the European Union agriculture market.

Since April 2021, Euronext is the owner of MTS2, the leading European fixed income trading platform, number one in Europe for Dealer-to-Dealer (D2D) European Government bonds trading, number one in Italian repo trading and number three in Europe for Dealer-to-Client (D2C) European Government bonds trading.

Euronext’s advanced data services business distributes and sells real-time, historic and reference data to global data vendors, such as LSEG Refinitiv and Bloomberg, as well as to financial institutions and individual investors. With a portfolio of over 1,250 benchmark indices, including the CAC 40® index in France and AEX® index in the Netherlands, Euronext is a leading provider of indices and a provider of advanced analytics products. Euronext’s blue-chip index franchise was enriched in 2023 through the addition of the CAC SBT 1.5 index family. Euronext is one of the leading ESG index issuers in Europe, with more than 18 new ESG indices launched in 2023 and a strong pipeline.

Post trade is an important part of the services Euronext provides to its clients. In 2013, the Company entered into a clearing agreement with LCH S.A., the Paris-based clearing house of LCH Group Limited (LCH Group), for the clearing of Euronext’s cash products. In 2017, Euronext renewed the separate derivatives clearing agreement with LCH S.A. that provides for a revenue sharing arrangement in respect of the clearing of Euronext listed derivativesl. On 29 April 2021, Euronext acquired the multi-asset clearing house CC&G, which it will grow into Euronext Clearing, making it by 2024 Euronext’s CCP of choice for its cash equity, listed derivatives and commodities markets. In January 2023, Euronext has decided to terminate the existing derivatives clearing agreement (the “Agreement”) with LCH SA, under the terms of the Agreement. Therefore, on 16 January 2023, Euronext served LCH SA notice of termination for the purposes of the Agreement. Since 2016, Euronext also offers user choice in clearing for the equity markets within the Eurozone, through the implementation of a preferred Central Counterparty (CCP) model followed by a fully interoperable service. Euronext continues to offer an open access CCP model for cash equity clearing.

In addition, Euronext owns and operates Euronext Securities Porto, the Portuguese national Central Securities Depository (CSD); Euronext Securities Oslo, the Norwegian national CSD; Euronext Securities Copenhagen, the Danish national CSD; and Euronext Securities Milan, the Italian national CSD. The Group is now the third-largest CSD operator in Europe. Euronext has combined its four CSD brands into Euronext Securities, a new umbrella brand for its CSD business, while keeping a strong local presence and identity.

Euronext Technology Solutions & other comprises Euronext’s commercial technology solutions and services business, and former Borsa Italiana businesses including Gatelab and Integrated Technology Services ‘X2M’. Euronext offers custom solutions and cost-effective services to exchanges, venue operators, and financial institutions, who require advanced functional capabilities, and low latency processing across multiple-asset classes surrounded by exchange grade business services used to operating within highly regulated environments.

The successful migration of the Euronext Core Data Centre facility from Basildon, in the United Kingdom, to Bergamo, in Italy has provided clients with a state-of-the-art colocation facility and connectivity services fully managed by Euronext within a data centre powered by renewable energy. Colocation and connectivity services have become an important source of revenue for Euronext Technology Solutions.

-

1.4 Regulation

1.4.1 OVERVIEW

The Euronext Group provides exchange listing, trading, post-trade and related services in Europe. The Company operates Regulated Markets and Multilateral Trading Facilities (MTFs) in seven European countries (Belgium, France, Ireland, Italy, the Netherlands, Norway, and Portugal). The Group operates these venues under a regulatory licence, under national legislation implementing MiFID II / MiFIR granted to the local market operator and the relevant National Competent Authority (NCA) or Ministry when appropriate. Each market operator is subject to the national laws and regulations supervised by the NCAs, central banks and finance ministries as appropriate. As part of their regular supervision, NCAs perform from time-to-time audits, inspections and on-site visits. This may lead to recommendations or other measures as appropriate.

The Group also operates central securities depositories (CSDs) in four European countries (Denmark, Italy, Norway and Portugal). Each of the CSDs is a limited liability company subject to national laws and regulations; however they all operate under the brand “Euronext Securities”. VP Securities AS (Euronext Securities Copenhagen), Monte Titoli S.p.A. (Euronext Securities Milan), Interbolsa S.A. (Euronext Securities Porto), and Verdipapirsentralen ASA (Euronext Securities Oslo) hold a licence under the CSDR, under limited national implementing provisions, granted by their NCA on 3 January 2018,18 December 2019,12 July 2018, and 28 January 2022 respectively.

Euronext, through Euronext Securities Copenhagen, Euronext Securities Milan and Euronext Securities Porto, participates in the ECB’s TARGET2-Securities (T2S) platform. The CSDs migrated respectively in September 2016 (Danish Kroner), August 2015 and March 2016.

Moreover, the Group operates a Central Counterparty in Italy, Cassa di Compensazione e Garanzia S.p.A (“Euronext Clearing”). The company was incorporated on 31 March 1992, holds its registered office in Rome at Via Tomacelli 146, and is registered with the Italian Register of Companies under no. 04289511000. It is authorised by the Bank of Italy as a CCP pursuant to Article 17 of EMIR with effect from 20 May 2014.

-

2 RISK MANAGEMENT & CONTROL STRUCTURE |DR|

Euronext analyses and monitors risks related to its activities with specific attention those whose occurrence could have a material impact on the Group’s business. The table of the Group’s principal risks categorises, the most material risks taking into account the impact and the probability of their occurrence.

Although Euronext believes that the risks and uncertainties described below are the material risks and uncertainties concerning the Group’s business and industry, they are not the only risks and uncertainties relating to the Group. Other risks, events, facts or circumstances not presently known to Euronext, or that Euronext currently deems to be immaterial could, individually or cumulatively, prove to be important and may have a significant negative impact on the Group.

2.1 Risk Factors

Strategic Risks Strategic Transformation Risk Regulatory Evolution and Enhanced Regulatory Scrutiny Risk Global and Regional Economy Risk Competition Risk Operational Risks Cyber Security Risk

Technology Risk

Third Party Risk Business Continuity Risk Employee Risk

Regulatory and Liabilities Risk Financial Risks Credit Risk Market Risk Liquidity Risk Capital Requirements Risk Euronext recognises the importance of environmental, social and governance (“ESG”) related risks. Based on our 2023 risk analysis, no material residual (unmitigated) ESG core business risks have been identified as impacting the operations, revenues and stakeholders of the Group.

The risk factors annotated by a reference symbol indicate material business risks that have an ESG dimension and link to the key ESG issues as identified by the Group’s external stakeholders in the Group ESG materiality matrix (see Section 3.1 - Value Creation by Euronext of this document for more information) labelled under 5 impact areas have been identified according to these categories.

Risk Identification and Description Potential Impact on the Group The Group’s strategy includes the identification and implementation of organic initiatives and new business initiatives such as acquisitions and partnerships.

The market for acquisition targets and strategic alliances is highly competitive, the Group acts on opportunities as they arise and may continue to enter into simultaneous business combination transactions.

The size, number and complexity of past acquisitions and those that may be executed in the near future, as well as ongoing enhancement programmes creates a strategic transformation risk for the Group.

Notably, the Group has continued the integration of Borsa Italiana which is principally driven by the migration of Borsa Italiana markets to the Optiq® platform and the expansion of the Group’s CCP, Euronext Clearing.

Over 2023, the Group achieved two significant milestones with respect to the migration of Borsa Italiana markets to the Optiq® platform, and is expected to complete the final milestone in the first half of 2024. The Group delivered the first milestone of its CCP expansion with the internalisation of its cash equity clearing for non-Borsa Italiana markets onto Euronext Clearing in 2024, the final milestone is expected in mid-2024.

There are varying degrees of dependency between the above-mentioned projects and there is a risk that, should the last milestone of the Optiq® migration project be significantly delayed, the second phase of the Clearing expansion may be impacted.

Beyond the above mentioned projects, the Group is undergoing other group-wide business transformation programs, including the development of its convergence plan across the Group CSDs.

Pursuing strategic transactions requires substantial time and attention of the management team, and of key employees managing or working on the integration/project activities. This could prevent oversight of other initiatives, reduce bandwidth for business as usual activities and slow other ongoing projects or initiatives. Late, incomplete or unsuccessful integrations or projects may impact the Group’s strategic plan, business, reputation and financial results.

The ability to adapt to a rapidly changing company culture by Euronext’s employees is necessary to ensure successful integrations and transformation. Failure to meet the demands of the changing company culture could negatively impact the advancement of projects and successful integration.

If integration programs are not completed, do not operate as intended, are delayed or identified synergies are not delivered, Euronext’s strategic ambition and reputation may be at risk.

Risk Identification and Description Potential Impact on the Group The Group’s businesses are subject to extensive regulation and supervision at both European and national levels in the jurisdictions in which the Group has operations: Belgium, Denmark, France, Ireland, Italy, the Netherlands, Norway, Portugal and the United Kingdom. In addition, the Company has a presence in the United States, Singapore, Finland and India.

Regulatory changes may impact the operating environment of Euronext exposing the Group to risks associated with the implementation and maintenance of compliance with new regulatory requirements. As the Group expands, so has the scope of regulatory requirements to which it is subject and the breadth of relevant relationships it must maintain. The regulatory environment is an important element that may limit the ability of the Group or its entities to provide certain current or planned services, or build an efficient, competitive organisation.

The Group must obtain regulatory approval to implement significant changes to the operations of its trading venues, and material changes to operations and models of its CCP and CSDs. Transformational cross-organisation projects include the Borsa Italiana markets migration to Optiq and the expansion of Euronext Clearing. Failure to obtain required approvals, which may need approval by multiple regulators, may delay or prevent the Group from achieving its strategic objectives.

With regards to MiFID II/MiFIR, an agreement on the Commission proposal was struck in the summer of 2023, however the official text has yet to be adopted and published. The outcome represents a risk for market data revenues. The scope of the pre-trade consolidated tape is limited to anonymised top-of book EBBO data, shares and ETFs, while post-trade data applies to shares, ETFs, bonds, and OTC derivatives. The revised market structure regulatory framework, may potentially benefit off-venue trading with alleviations introduced on bank internalisation. At the same time, a ban on Payment for Order Flow (PFOF) has been introduced, including a grandfathering provision for member states with existing structures in place until June 2026.

The Commission proposal for the Benchmark Regulation review should be positive as it aims to limit the framework to critical, significant and environmental benchmarks and is expected to apply in 2026. The Commission proposal on the Retail Investment Strategy seeks to improve the framework for retail investors, and there is a risk, subject to the final outcome, of unintended consequences in terms of limiting retail access to financial markets further. The Commission proposal on ESG Ratings seeks to install safeguards on transparency and is expected to be positive for the market that relies on ESG ratings.

In December 2022, the Commission proposed a review of EMIR and a new Listings Act, both which are potentially positive. The Listing Act is expected to be agreed in Q1 2024 with the aim of simplifying the listing process by streamlining prospectus and market abuse requirements. The EMIR review seeks to improve new product and service authorisation procedures and is expected to be agreed in 2024.

With regards to the CSDR framework, the EU Commission addresses access to commercial bank money for settlement purposes, as well as services passports, both requiring effort to implement. The Withholding Tax proposal, proposes that CSDs should register as Certified Financial Intermediaries, potentially causing additional burdens in this area.

Beyond market infrastructure regulation, the Group is subject to increased regulation in the areas of IT, cybersecurity, and outsourcing, particularly with the Digital Operational Resilience Act (DORA) which will be applicable in 2025. Level 2 Regulation is being prepared and consultations will continue over the course of 2024.

In 2023 the Distributed Ledger Technology (DLT) Pilot Regime entered into force permitting exemptions to MIFID and CSDR to manage financial instruments through new DLT infrastructures that could benefit from these exemptions, potentially increasing competition. The Markets in Cypto Assets (MICA) Regulation will be applicable in 2024 regulating the provision of services of crypto assets potentially allowing crypto asset service providers to leverage their more regulated structure and start competing on traditional financial instruments.

ESG regulation continues to evolve, with the final four objectives of the EU Taxonomy for Sustainable Activities published in 2023. The Corporate Sustainability Reporting Directive (CSRD) was finalised and will be transposed into national regulations in 2024. The negotiations of the Corporate Sustainability Due Diligence Directive (CSDDD) were provisional agreed in December 2023, however during a meeting of the Coreper in February 2024, the agreement failed to receive sufficient support at the European Council level.

Decisions by Euronext’s regulators to impose measures may impact the competitive situation and possible strategy of the Group. Adherence to new and evolving regulatory regimes implied increase compliance and associated costs for the Group, for instance by requiring the businesses of the Group to devote substantial time and cost to the implementation of new rules and related changes in their operations. It may also impact the ability to outsource certain activities and/or place financial and corporate governance restrictions on the Group and its entities.

As the Group grows its product base and the jurisdictions in which it operates, regulatory oversight of the Group’s activities by additional regulatory bodies potentially increases regulatory constraints or increases compliance requirements if adversely designed could materially increase the costs of, and restrictions, of its activities.

Delays or denials by regulatory authorities of approvals requested by Euronext required to implement its strategic initiative, or to pursue business opportunities could have a significant impact on Euronext’s competitive positioning and growth.

The impacts of the proposed amendments to MiFIR remain difficult to assess. The changes to the structure of the market data business including both reasonable commercial basis provisions and the creation of a consolidated tape may negatively impact market data business revenues in the medium term. The same may be the case for market structure reforms.

On the post-trade side, the CSDR and EMIR Reviews are generally positive for the Group, potentially facilitating these businesses, however, the legislative process still needs to be finalised. The potential impact of the EMIR review is expected to include changes to the supervisory regime, authorisation procedures foreseen within EMIR, which may result in the relocation of clearing flows related to certain derivatives asset classes from the UK to the EU. The Withholding Tax proposal may however add regulatory burdens on CSDs. The Benchmark Review may reduce regulatory burdens on the indices offered by the Group.

With respect to the DLT Pilot Regime and MICA Regulation, in the medium term, the estimated impact, due to the asset perimeter is expected to be limited. In the longer term, more flexible provisions of digital finance may be extended to a broader asset perimeter, and enable new competition on Euronext’s core activities, with the main impacts expected on bond listing, post-trade and retail trading activities.

If competitors (including those in third party jurisdictions) can obtain regulatory approval for similar products (including new digital products) or services faster than established entities such as the Group or its subsidiaries, or with lower regulatory burdens than regulated entities, the Group’s competitive position may be weakened.

Well-designed legislation in respect of IT, cyber security and outsourcing, notably DORA can be expected to assist the Group in its operations on a cross-border basis, particularly in harmonising reporting obligations. However, compliance risks can be expected to increase.

ESG regulations require increasing time and resources to ensure correct implementation and continued compliance changes and adaptation processes, including training and awareness for employees. Potential impacts of new regulations will be determined by the scope of application of new regulations and directives.

Risk Identification and Description Potential Impact on the Group The Group is exposed to global and regional economic, political and geopolitical market conditions, macro-economic changes in global or regional demand or supply shifts and legislative changes across several jurisdictions, which can affect the level of global and local financial activity.

The general economic conditions as well as unanticipated, impactful events, and general economic conditions affect financial and securities markets in a number of ways, from determining availability of capital, to influencing investor confidence. Adverse changes in the economy or the outlook for the financial and securities industry can have a negative impact on the Group’s revenues through declines in new listings, trading, clearing and settlement volumes, and demand for market data.

Starting in 2022, inflation in Europe and the US increased to its highest in several decades, driven by the lingering impacts from the pandemic and its recovery, and exacerbated by the war in Ukraine and subsequent sanctions to the Russian invasion. Over 2023, inflation continued however slowing as Government responses to curb inflation continued over 2023. In the second half of 2023 Central Banks slowed the increase of interest rates buoying the economy and supporting equity trading and valuations and ultimately business activity. Market and FED expectations are for 75 basis point rate cut in 2024, supporting economic growth.

GDP in the euro area, where the Group’s activities are concentrated, was weaker in 2023 than expected due to Germany’s slowdown and 2024 may confirm this trend. Eurozone GDP growth in 2024 is expected to be close to zero to 0.5%. Low or negative growth may impact trading, and increased credit risk in the Euro area, reduce appetite for risk including trading activities by participants. Additionally, primary listing activities have been impacted given challenging market conditions in 2023 and may continue in 2024 further impacting the Group.

While volatility may drive volumes on trading venues, the recession and slow GDP growth may be reflected in issuance and trading, clearing and settlement volumes, and demand for market data, which may negatively impact Group revenue and growth targets. Declines in volumes may also impact the Group’s market share or pricing structures.